Ever since Bachelier’s PhD thesis in 1900 — a theory of Brownian motion 5 years before Einstein — our understanding of financial markets has reasonably progressed. Over the past decades financial engineering has grown tremendously and has regrettably outgrown our understanding. The inadequacy of the models used to describe financial markets is often responsible for the worst financial crises, with significant impact on everyday economy.

From a physicist’s perspective, understanding price formation in financial markets — namely how markets absorb and process information of thousands of individual agents to come up to a “fair” price — is a truly fascinating and challenging problem. Statistical physics has taught us that systems made of a large number of individual entities may display robust (often unanticipated) regularities that rise above individual behaviours. Or as P. W. Anderson puts it “More is different”, see Science 177 (1972).

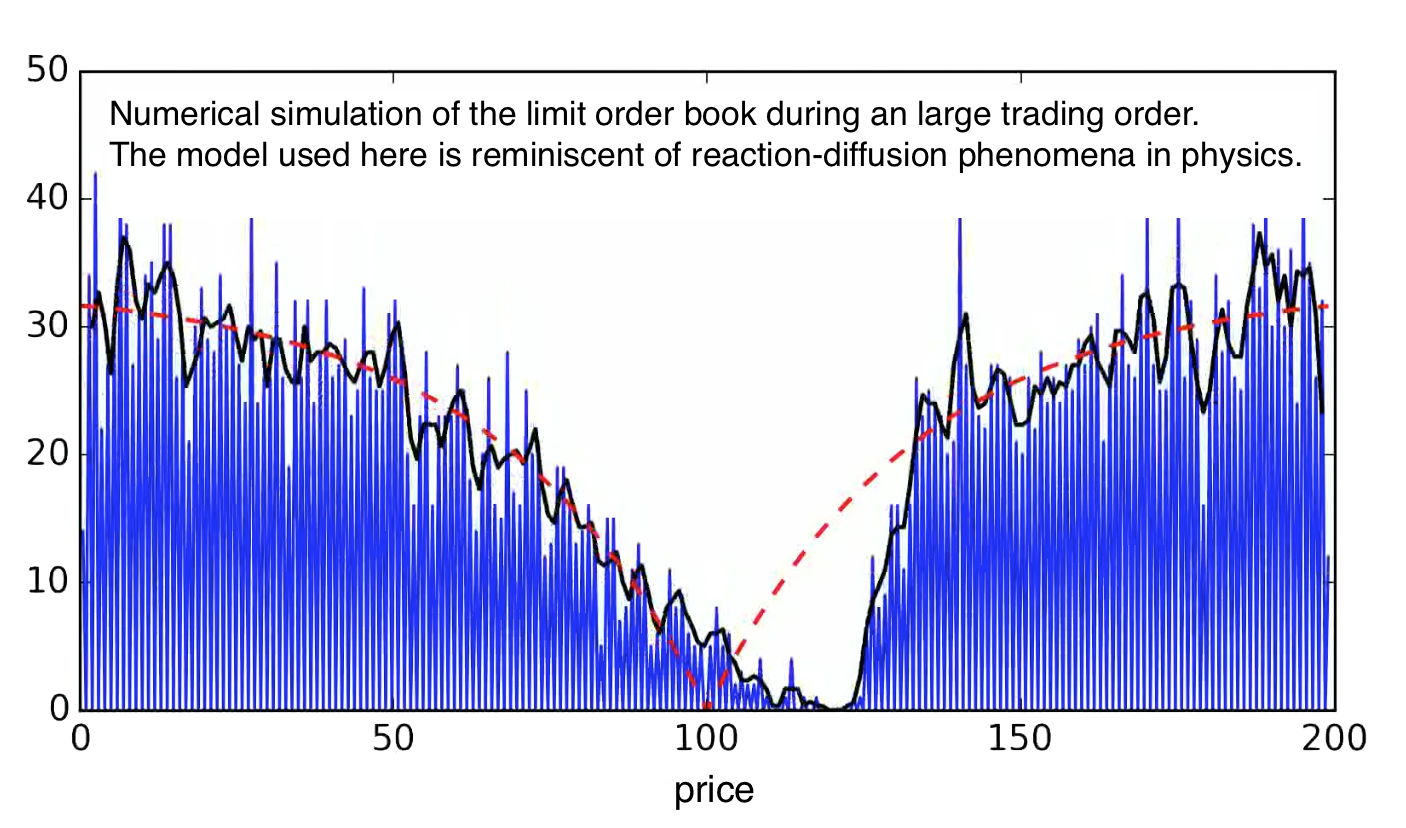

Our approach is primarily empirical. We work in collaboration with J.-P. Bouchaud (chairman at Capital Fund Management) on building self-consistent agent-based models able to reproduce stylised facts revealed by real market data. The success of zero-intelligence “hydrodynamic” models (see figure above) comforted us in the idea that market dynamics can, to some extent, be understood from a purely mechanical endogenous perspective, in conflict with most economical models. In particular models need no exogenous ingredients (such as news reports) to be able to reproduce a number of well-established empirical findings. One remarkable observation is that only a very small fraction of large price jumps can be correlated to news feeds, indicating that most small-scale market crashes seem to be induced by the dynamics of the market itself. Using the class of continuous models mentioned above and keeping an ear open for what real data may tell us, we now concentrate on understanding what can trigger unstable feedback loops and destabilise markets, a question of indisputable economical and societal importance.

When the wind blows over the ocean, it generates surface waves. The mechanism underlying this observation is not yet fully understood. The current theories can be traced back to the 50s’ (see [1,2]). Phillips suggested that pressure fluctuations in the air must be the central ingredient, while Miles suggested that tangential shear stress at the interface is responsible for surface waves generation. As of today both theories — based on different physical mechanisms — have not proven contradictory and are still jointly used in geo-physical Science. Both pressure and shear stress at the interface may play a key role in the generation of waves by the wind, but a unified picture is still lacking.

In collaboration with the experimental team of M. Rabaud and F. Moisy at the FAST laboratory (Orsay) (see [3]), we aim at disentangling the role of pressure and shear stress on the deformation of a viscous liquid interface. One could say that the air-water interface acts as a spatial and temporal filter of near-wall turbulence in the air. Using lubrication theory together with viscous surface waves theory, we intend to understand the crucial role of viscosity on surface wrinkles and the onset of wind-wave generation.

[1] O. M. Phillips. On the generation of waves by turbulent wind. J. Fluid Mech. 2(05), (1957).

[2] J. W. Miles. On the generation of surface waves by turbulent shear flows. J. Fluid Mech. 7(03) (1960).

[3] A. Paquier, F. Moisy, and M. Rabaud. Surface deformations and wave generation by wind blowing over a viscous liquid. Phys. Fluids 27 (2015).

(...)

© Untitled. All rights reserved. | Design by TEMPLATED.